First-time homebuyers made up 34% of home sales in 2021.

Purchasing a home is a great accomplishment, but it is also overwhelming. There are so many things to consider, one of which is the down payment.

Knowing how to save for a down payment and how much money you need is a crucial part of the home-buying process and people don’t talk about it enough. If you’re considering purchasing a house, you need to have realistic expectations and set some goals.

This guide will teach you everything you need to know about a home down payment. Keep reading so you know precisely how much money you need to purchase your dream home.

Table Of Contents

What Is a Down Payment

A house down payment is going to be the sum of money that you put into a home from the start. You’ll then use a loan to cover the rest of the cost.

The amount that is required for a home down payment varies depending on a number of different things. How much the home costs is going to be a big determining factor, as well as what type of loan you get, and how much you’re being lent.

Putting Down 20%

Putting 20% down on a home is typically considered the golden number for several reasons. Since the 2008 housing market crash, lenders and banks have pushed people to put 20% down because it shows the borrower’s financial status and it proves the borrower is committed to paying the loan.

This number has discouraged many people from purchasing a home because it’s so much and it takes a long time to save up that much money. People don’t like the idea of spending their entire savings on the down payment, and rightfully so. You don’t have to necessarily put 20% down, but we are going to go over the pros and cons so you can make an informed decision.

Pros

If you are able to put 20% down you will avoid paying PMI, which is private mortgage insurance. PMI is put in place to protect the lender if you default on your mortgage. If you don’t put 20% once you have enough equity in the home, you can request the lender remove it.

When you’re purchasing a home, you want the best interest rates possible. This will decrease the amount you have to pay every month.

Putting 20% or more down when you’re buying a house will likely decrease your monthly payment. Even lowering your interest rate by even a few points will save you thousands of dollars.

Another benefit of putting more money down is lower monthly payments. With lower monthly payments, you’ll have more money for other things such as repairs, maintenance, and upgrades.

Cons

There are a few downsides that come with a high down payment. It can take you a lot longer to save, which means your home purchase will be delayed.

Once you put the money down it’s very hard to get it back, so if you think you’ll need the money in the future it’s best not to put it all towards to down payment. The more money you put down, the less you have for repairs and maintenance in the future. If you have to pull out of your emergency fund for your down payment, it may be best to wait and save a little more.

Loans and Down Payments

There are several different loans you can get and they each have different requirements when it comes to money down on a house. If you’re purchasing your first home or a primary residence, the requirements will be different than if you were to buy an investment property or a second home.

Conventional

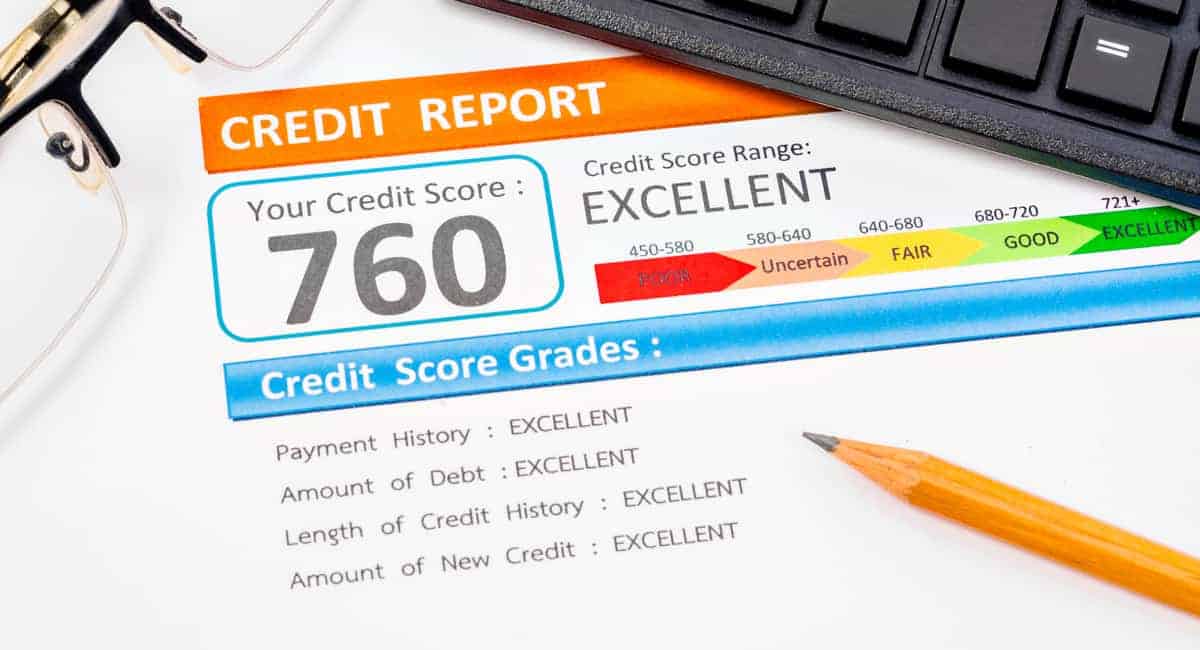

If you’re getting a conventional loan for your primary residence, the amount you must put down is up to the lender. They may only require you to put 3% or it could be 5%. The higher your credit score the better.

If you’re getting a loan for a second home, you’ll be required to put at least 10% down. This is because the lender is taking a risk because you already have one loan.

A conventional loan is the only loan you can get if you’re purchasing an investment. You’ll be required to put in between 20% and 25%.

A lender may give you the option to put 15% down if you have a good credit score. If you’re struggling to get the money because of your credit score or for any other reason there are down payment assistance programs that can assist you.

FHA

FHA loans are great if you’re buying a primary residence. The amount that is required for a down payment is 3.5%; however, you can put more into it if you want. If you have a credit score between 500 and 579, you will likely have to put 10% down.

VA Loan

If you serve or served in the military, you may qualify for a VA loan. If this is the case, a down payment is not required. The amount of time you served and your discharge reason is important, so be sure you have the information on hand when you’re applying for the loan.

Home Down Payment Savings

There isn’t one answer to the question “how much do I need for a downpayment”. As you can see there are several factors that play into the amount needed.

Don’t get discouraged if you don’t have 20% for a home down payment. There are many lenders out there that will give you a loan if you put 3% down.

We hope you found this article helpful, if so check out our site for more. We have many articles and blogs about finance that you may find interesting.